The Chinese-style modernization has put forward new requirements for the high-quality development of finance. The 20th National Congress of the Communist Party of China pointed out the need to deepen the reform of the financial system, establish a modern central bank system, strengthen and improve modern financial regulation, enhance the financial stability assurance system, legally incorporate all types of financial activities into regulation, and ensure that no systemic risks occur. In order to further enhance academic exchanges and discuss the core issues in China's financial reform, development, and innovation, and to promote cutting-edge research and innovative cooperation in the financial field, and provide theoretical research support for the formulation of national economic and financial policies, the "2023 Financial High-end Academic Forum" was successfully held at the Cui Ping Mountain Hotel in Nanjing, Jiangsu Province from October 20th to 22nd, 2023.

This forum was organized by the School of Economics and Management and the Big Data Laboratory for Financial Management at Southeast University, with the Department of Finance at Southeast University as the executor, and co-organized by the Capital Market Research Association of Jiangsu Province. The conference invited outstanding experts and scholars from more than 20 well-known domestic universities, including Tsinghua University, Nankai University, Fudan University, Renmin University of China, Nanjing University, University of Science and Technology of China, Xiamen University, Beijing Normal University, Central University of Finance and Economics, and Shanghai University of Finance and Economics, to jointly discuss the core issues in the field of finance. The forum covered discussions on the development, reform, innovation, regulation, and security of finance, international finance, asset pricing, corporate finance, digital finance, green finance, supply chain finance, and financial risk management at the forefront of the financial field.

01 Opening Ceremony

At the opening ceremony, Professor Huang Dawei, Vice President of Southeast University, and Professor Yuan Jianhong, Secretary of the Party Committee of the School of Economics and Management at Southeast University, delivered speeches, extending a warm welcome and sincere greeting to all the guests and experts attending the conference. Professor Liu Xiaoxing, Director of the Department of Finance at Southeast University, presided over the opening ceremony.

02 Keynote Speech

The first half of the keynote speeches was chaired by the Associate Dean and Vice President of the Party Committee of the School of Economics and Management, Professor Yin Wei. Professors Liang Qi from Nankai University, Yin Zhichao from Capital University of Economics and Business, and He Qing from the School of Finance and Economics at Renmin University of China respectively delivered their keynote speeches.

Professor Liang Qi gave a speech titled "Why is the Chinese stock market in a long-term slump? Reflections on the spillover of bad volatility across markets." Professor Liang pointed out that the long-term slump of the Chinese stock market is inconsistent with its sustained economic growth, and the input-type risk from the Hong Kong market may be one of the important reasons. Professor Yin Zhichao delivered a speech titled "New Impetus for Upgrading Household Consumption: Evidence Based on the Inclusive Perspective of the Digital Economy." Based on China's household financial survey data, Professor Yin comprehensively evaluated the impact of the digital economy on the upgrade of household consumption from a micro perspective, providing valuable references for promoting the upgrade of household consumption through the digital dividend. Professor He Qing gave a speech titled "Clan Culture and Banking Competition," mainly discussing and revealing the impact and mechanism of clan culture on banking competition.

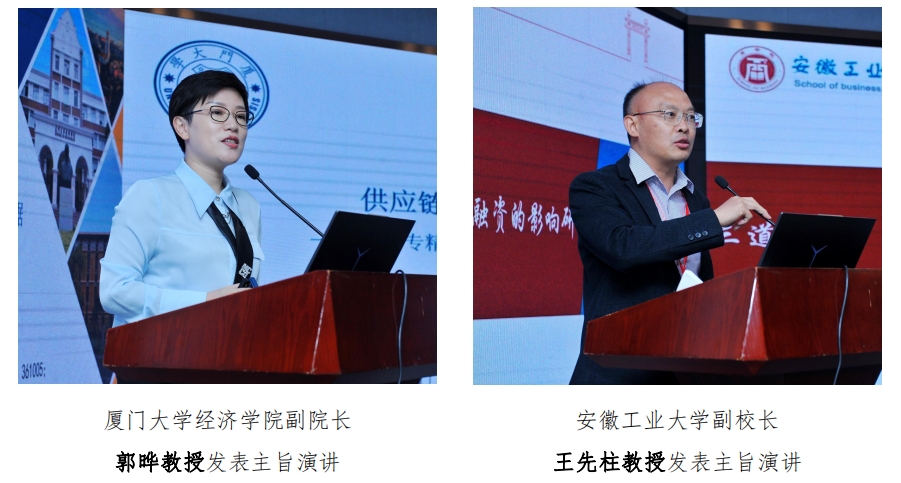

The second half of the keynote speeches of the conference was chaired by Professor Zhang Ying, Associate Dean of the School of Continuing Education at Southeast University. Professor Guo Ye, Associate Dean of the School of Economics at Xiamen University, Professor Wang Xianzhu, Vice President of Anhui University of Technology, and Professor Liu Xiaoxing, Director of the Finance Department at Southeast University, each delivered keynote speeches.

Professor Guo Ye delivered a speech titled "Stable chain effects of supply chain financing development: Micro evidence based on the 'specialized, special, and new' small and medium-sized enterprises entering the chain." Professor Guo focused on examining the stable chain effects of the integrated development of the supply chain and found that when "specialized, special, and new" small and medium-sized enterprises become the main suppliers of core enterprises, it significantly enhances the product competitiveness of the core enterprises. Professor Wang Xianzhu delivered a speech titled "The impact of the 'three red lines' policy on the debt financing of real estate enterprises: A study of the influence of the 'door-closing and window-closing' policy." Professor Wang clarified the transformation process of the financing structure of real estate enterprises under policy regulation by comparing the effects of the "three red lines" policy on interest-bearing and non-interest-bearing financing of real estate enterprises and proposed that the current real estate market regulation should provide classified guidance, be flexible, and actively broaden the equity financing channels for real estate enterprises. Professor Liu Xiaoxing delivered a speech titled "Abnormal capital flows, risk spillover networks, and financial system stability," which re-examined the impact of abnormal capital flows on the stability of the financial system from a global perspective and analyzed the underlying mechanism behind this impact by constructing a risk spillover network. Professor Liu pointed out that market sentiment is an important driving factor for the risk spillover of the financial system, and the foreign exchange market is the main net recipient of risk. Strict control of cross-border capital flows and central bank intervention in the foreign exchange market help to curb the negative impact of abnormal capital flows on the stability of the financial system.

03 Sub-forum I

Sub-forum I was chaired by the Associate Dean and Vice President of the Party Committee of the School of Economics and Management, Professor Yin Wei, and Professor Gao Yanyan from the School of Economics and Management. Professor Zhu Xiaoneng, Director of the Academic Affairs Office at Shanghai University of Finance and Economics, Professor Liu Qingfu, Executive Director of the Fudan-Stanford Institute for China Financial Technology and Security, Professor Xiong Deping, Honorary Dean of the School of Finance at Yunnan University of Finance and Economics, Professor Wang Yudong, Dean of the School of Economics and Management at Nanjing University of Science and Technology, Professor Lin Hui, Director of the Research Center for Financial Econometrics and Risk Management at Nanjing University, and Professor Gong Zaiwu, Dean of the School of Management Engineering at Nanjing University of Information Science and Technology, each delivered keynote speeches.

Professor Zhu Xiaoneng's report was titled "Research on the Price, Trading Returns, and Utility of Data Asset Elements." Professor Zhu established models for the pricing of data assets in intelligent contract membership, data asset trading platforms, and data asset portfolios. He studied the relationship between data asset prices, trading returns, and utility in the context of data ownership and beneficial rights trading methods. Professor Liu Qingfu's report was titled "Live-Streaming Recommendation and Mutual Fund Performance." Professor Liu used machine learning technology to process real-time streaming content and construct quantitative indicators to examine the impact of live streaming on mutual fund performance and found that live streaming has a significant impact on mutual fund performance. Professor Xiong Deping's report was titled "Theoretical Logic of the Development of Inclusive Finance with Chinese Characteristics." Based on the experience of the development of inclusive finance with Chinese characteristics, Professor Xiong proposed a development model for inclusive finance with Chinese characteristics, addressing the current definition of defects and practical problems, and emphasizing "a fulcrum, two levers, and three integrations." Professor Wang Yudong's report was titled "Is Information Risk Priced? New Evidence from Outer Space." Professor Wang tested the asset pricing performance of cloud-based information risk measurement indicators and found that they have significant asset pricing capabilities. Professor Lin Hui's report was titled "Credit Risk and Equity Returns in China." Professor Lin mainly examined the impact of credit risk on stock market returns in China and found that stocks with higher credit risk have higher expected returns and that credit risk premium is an important component of stock returns in China. Professor Gong Zaiwu's report was titled "The Relative Importance of Overnight Emotions and Trading Period Emotions in Volatility Forecasting." Professor Gong mainly discussed the importance of overnight emotions relative to trading period emotions in volatility forecasting, finding that overnight emotions carry more information than trading period emotions, as overnight emotions are driven by information, while trading period emotions are easily influenced by prices.

Sub-Forum I Hall

04 Sub-forum II

Sub-forum II was chaired by Professor Li Shouwei, Associate Director of the Finance Department of the School of Economics and Management, and Associate Researcher Guo Haochen from the School of Economics and Management. Professor Lu Yao, Associate Director of the Finance Department at Tsinghua University School of Economics and Management, Professor Zhang Xun from the Financial Statistics Department at the School of Statistics, Beijing Normal University, Professor Chen Rongda, Vice President of Jiaxing College, Professor Yu Honghai, Dean of the School of Engineering Management at Nanjing University, Professor Zhang Xueyong, Dean of the School of Finance at Central University of Finance and Economics, and Professor Huang Wenchao from the School of Computer Science and Technology at the University of Science and Technology of China, each delivered keynote speeches.

Professor Lu Yao's report was titled "How Does Human-Machine Collaboration Work?—Evidence from Auto Finance Leasing Transaction Data." Professor Lu thoroughly explored the formation mechanism of human-machine collaboration based on auto financing leasing transaction data. Professor Zhang Xun's report was titled "FinTech Adoption and Rural Economic Development." Professor Zhang focused on evaluating the impact of digital financial development on rural economic development and found that rural digital finance contributes to the increase of household income, especially wage income and property income. Professor Chen Rongda's report was titled "The Interactive Relationship between Multi-Dimensional Internet Financial Investor Emotions and Internet Financial Product Returns." Professor Chen quantified the multi-dimensional investor emotions of internet financial products and found that seven emotions (joy, anger, sadness, fear, calm, disgust, and surprise) increase market risk and reduce expected returns. Professor Yu Honghai's report was titled "Can Enterprise Digital Transformation Reduce Supply Chain Risks?—From the Perspective of Text Analysis." Professor Yu innovatively measured the level of supply chain risk at the enterprise level and explored the impact of digital transformation on supply chain risk, finding that digital transformation significantly reduces enterprise supply chain risk. Professor Zhang Xueyong's report was titled "Geopolitical Risk and Currency Returns." Professor Zhang focused on analyzing the relationship between geopolitical risk and currency excess returns and found that a zero-cost strategy of buying currencies from economies with higher geopolitical risk and selling currencies from economies with lower geopolitical risk can generate significant excess returns. Professor Huang Wenchao's report was titled "Smart Contract Security and Formal Automated Verification." Professor Huang introduced a secure protocol fully automated formal verification system and further proposed a fully automated modeling and financial attribute construction solution for massive smart contracts, achieving a fully automated analysis of smart contract financial security.

Sub-Forum II Hall

05 Sub-forum III

Sub-forum III was chaired by Professor Zhang Ying, Associate Dean of the School of Continuing Education, and Associate Professor Zhu Dongmei from the School of Economics and Management. Professor Yi Zhigao from the Business School of Nanjing Normal University, Professor Ma Yaming, Dean of the Graduate School and Director of the Discipline Construction Office at Tianjin University of Finance and Economics, Professor Peng Yuchao, Associate Dean of the School of Finance at Central University of Finance and Economics, Professor Wei Ping, Associate Dean of the Business School at Central South University, Professor Chen Chuanglian, Associate Dean of the Nanfang Institute of Finance at Jinan University, and Professor Xiang Houjun, Dean of the School of Finance and Investment at Guangdong University of Finance, each delivered keynote speeches.

Professor Yi Zhigao's report was titled "The Governance Effect of Enterprise Digital Transformation: From the Perspective of Financial Fraud." Professor Yi systematically studied the corporate governance effect of enterprise digital transformation from the perspective of financial fraud and found that digital transformation and the digital information technology background of corporate executives have a significant inhibitory effect on corporate financial fraud. Professor Ma Yaming's report was titled "Bank ESG Performance and the Risk Spillover of Real Economy to Banks." Professor Ma focused on analyzing the impact and transmission mechanism of bank ESG performance on the level of risk spillover from the real economy to banks and found that overall, bank ESG performance plays a risk-mitigating role. Professor Peng Yuchao's report was titled "Carbon Emission Dual Control Policies, Low-Carbon Transformation, and Economic Stability." Professor Peng proposed optimization of macroeconomic control methods and a shift from energy consumption "dual control" to carbon emission "dual control" as suggestions based on an in-depth exploration of the impact of carbon emission dual control policies on low-carbon transformation and economic stability. Professor Wei Ping's report was titled "Research on the Relationship between Green Finance and Environmental Inequality: Theory and Empirical Evidence." Professor Wei's research indicated that participation in the green finance sector can affect the degree of environmental inequality and that there is a significant inverted U-shaped relationship between green finance and environmental inequality. Professor Chen Chuanglian's report was titled "Credit Constraints and Macro-Prudential Policy: From the Perspective of Risk Prevention." Professor Chen elaborated on the impact of mortgage credit constraints on the decision-making of microeconomic agents from the perspectives of households and enterprises and proposed corresponding macro-prudential policy response strategies at the national level. Professor Xiang Houjun's report was titled "'Adding Flowers to the Brocade' or 'Sending Charcoal in Snow'?—A Study on the Impact of Government-Guided Funds on Enterprise Risk Bearing." Professor Xiang's research indicated that the introduction of government-guided funds significantly enhances the risk-bearing capacity of enterprises by alleviating financing constraints and agency problems, but its impact capacity exhibits obvious enterprise heterogeneity.

Sub-Forum III Hall

During the forum, more than 200 participants, including teachers from universities across the country and teachers and students from Southeast University were attracted. They actively interacted and exchanged ideas with the experts and scholars. The successful holding of this forum provided a good opportunity for experts, young teachers, and students in the field of finance to exchange their ideas and promote further attention and thinking on frontier issues in the field of finance. The experts in attendance will take this forum as an opportunity to further strengthen exchange and cooperation in the future, contributing to the high-quality development of finance and the economy in China.

(Contributed by: Department of Finance, Reporter: Wang Panpan)

Translated by: TangFeng

Reviewed by: Li Zhaoting