On October 16th, 2021, hosted by the Jiangsu Provincial Economics Graduate Education Steering Committee and undertaken by the School of Economics and Management of Southeast University, the 2021 Jiangsu Province Graduate Student Forum on "The People-Centered Financial Policy of the Communist Party of China: A Century of Evolution and Development", was successfully held. Affected by the epidemic, this forum was conducted online. More than 100 experts, scholars and graduate students from more than 60 universities across China, including Peking University, Fudan University, Shanghai Jiaotong University, Renmin University of China, Wuhan University, Central University of Finance and Economics, Beijing Normal University, Shanghai University of Finance and Economics, Capital University of International Business and Economics, Southeast University, Shanghai University of International Business and Economics, Nanjing University of Science and Technology, participated in the forum to study and discuss current theoretical and practical issues in the field of financial technology.

The opening ceremony of the forum was presided over by Professor Liu Xiaoxing from the Department of Finance, School of Economics and Management, Southeast University. Pei Yu, Vice Chairman of Jiangsu Province Economics Graduate Education Steering Committee, on behalf of the committee, Yuan Liudi, Deputy Dean of the Graduate School of Southeast University, on behalf of Southeast University and Yuan Jianhong, Secretary of the Party Committee of School of Economics and Management of Southeast University,on behalf of the School of Economics and Management of Southeast University, delivered speeches respectively.

Figure 1 the opening ceremony of the 2021 Jiangsu Province Graduate Student Forum on "The People-Centered Financial Policy of the Communist Party of China: A Century of Evolution and Development"

Figure 2 Speech by Pei Yu, Vice Chairman of Jiangsu Province Economics Graduate Education Steering Committee

Figure 3 Speech by Professor Yuan Jianhong, Secretary of the Party Committee of the School of Economics and Management of Southeast University

In order to inspire the spirit of the graduate students to actively explore scientific research issues, the organizers of the forum evaluated the selected papers and awarded 7 special prizes, 20 first prizes and 40 second prizes respectively.

After a brief opening ceremony, the conference entered the keynote speech session of the guests. Dean Li Jianjun from the School of Finance of Central University of Finance and Economics delivered a keynote speech on the theme of "CPC Centennial Financial Exploration and Modernization Choice". Li Jianjun pointed out that the origin of the return of finance to serve the real economy is the fundamental difference in the perception of the function of finance between Chinese socialism and other capitalisms in the world, and it is also the foothold for the modernization of China's financial governance. In its 100-year history, the financial governance of the Communist Party of China has gone through the logical thinking of the people's livelihood and the needs of the struggle during the New Democratic Revolution, the strategic consideration of mobilizing financial resources for industrial development during the socialist construction period, and the reform strategy of advancing to adapt to the socialist market economy model and converge with international rules after the Reform and Opening up. the new era of socialism with Chinese characteristics has opened a new journey toward the world and the practice of modern financial governance. It has always taken the allocation of financial resources, the stabilization of the general situation of economic and social development, and the guarantee of people's livelihood as the fundamental, and has constantly optimized the institutional system, mechanism design, and improved functions and efficiency, effectively supporting the realization of strategic goals at each stage.

Figure 4 Li Jianjun, Dean of the School of Finance, Central University of Finance and Economics, delivered a keynote speech

Professor Liu Xiaolei, director of the Department of Finance, Guanghua School of Management, Peking University, explained the current Chinese corporate governance model based on the theoretical framework of modern economics. The model, in other words, means that the central party indicates the direction, the grassroots party organization implements it, and the enterprise managers implement it, so as to maximize social welfare. The keynote report pointed out that the goal of enterprises is to maximize corporate profits, while the goal of party organizations is to maximize social welfare, reflecting the party's purpose and original intention of "serving the people". Complete enterprise autonomy will lead to insufficient provision of public goods. Only central party organizations or only grassroots party organizations can increase the provision of public goods, but still cannot achieve the optimum. The greater the information asymmetry between the central and the grassroots, the stronger the role of grassroots party organizations. Enterprises with a higher degree of party organization governance have fewer financial defaults and more social responsibilities. Compared with central enterprises, this result works more clearly in local state-owned and private enterprises with higher information asymmetry.

Figure 5 Professor Liu Xiaolei, Director of the Department of Finance, Guanghua School of Management, Peking University, delivered a keynote speech

Wu Wenfeng, Vice Dean of Antai College of Economics and Management of Shanghai Jiaotong University discussed the anomaly of asset prices in the corporate bond market based on the decomposition analysis with the theme of "Asset growth anomaly in corporate bond market: A decomposition analysis". The results of the study found that improvements in collateral were strongly correlated with subsequent performance, negatively correlated with bond yields, but positively correlated with changes in bond yields. Further analysis of changes in bond performance showed that most bond performance changes do come from changes in yield spreads, with realized bond performance significantly attributable to collateral-induced changes in yield spreads.

Figure 6 Wu Wenfeng, Vice Dean of Antai College of Economics and Management, Shanghai Jiao Tong University, delivered a keynote speech

Professor Hu Haifeng, director of the Department of Finance of the School of Economics and Business Administration of Beijing Normal University, had a heated discussion with the experts and students on the new characteristics, new challenges, and preventive countermeasures of our nation's financial risks in the new development stage. The report pointed out that coordinating the prevention and resolution of major financial risks is a major task to safeguard the national economic interests and the long-term interests of the people and has great practical significance for promoting high-quality development and building a new development pattern. During the "13th Five-Year Plan" period, our nation has firmly maintained the bottom line of no systemic financial risks, and firmly safeguarded the country's economic and financial stability and the safety of people's property. During the "14th Five-Year Plan" period, the external environment faced by our nation has become more complex, instability and uncertainty have increased significantly, the problem of unbalanced and insufficient domestic development is still prominent, and there are still some persistent problemsand incipient and tendentious hidden dangers in the field of financial risks. To coordinate the prevention and resolution of major financial risks, it is necessary to consolidate the foundation of financial stability, properly handle the relationship between stable growth and risk prevention, resolve systemic financial risks with high-quality economic development, and effectively prevent and resolve various possible risks.

Figure 7 Professor Hu Haifeng, Director of the Department of Finance, School of Economics and Business Administration, Beijing Normal University, delivered a keynote speech

Zhang Lei, general manager of the investment banking department of Huatai United Securities, shared his thoughts on the changes brought about by the registration system and the high-quality development of enterprises. The report analyzes the impact of the registration system on the development of our nation's capital market and enterprises and points out that with the deepening of the registration system pilot, "one center", "two links" and "three market-oriented arrangements" promote. brand-new changes of China's capital market: the listing conditions of enterprises are more inclusive, the listing review is more predictable, and the stock issuance is more market oriented. Under the new capital market situation, the A-share market has undergone a series of changes. The changes are mainly reflected in the transformation from a seller's market to a buyer's market; the market value is differentiated, and the trend of head-to-head is obvious; securitization dividends are gradually disappearing, and listing behavior is more rational.

Figure 8 General Manager Zhang Lei, Director of the Investment Banking Department of Huatai United Securities, delivered a keynote speech

Associate Professor Yin Wei, Secretary of the Party Branch of the Department of Finance, School of Economics and Management, Southeast University, shared the classic cases of red finance from the perspective of the historical experience and practice of red finance, summed up the practical experience from a historical perspective, thought deeply about the prevention and control of financial security risks in the new era, and proposed to actively explore the frontier issues of people-centered financial practice and innovation.

Figure 9 Associate Professor Yin Wei, Secretary of the Party Branch of the Department of Finance, School of Economics and Management, Southeast University, delivered a keynote speech

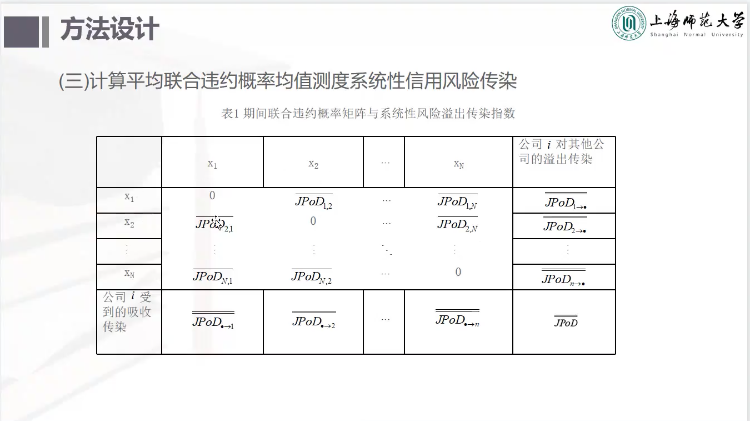

On the afternoon of the 16th, the conference conducted a theme report and comment session on the selected papers in the form of a sub-forum. According to the theme of the competition, a total of 11 sub-venues were set up. Topics include evolution of financial theory and policy development, financial policy and practice, financial technology and financial supervision, green finance and sustainable development, financial risk management and financial security, corporate finance, high-quality financial and economic development, financial practice and innovation, inclusive finance and collaborative development and international finance. The authors of the entries at each venue made wonderful reports, and the participating graduate students had active interactions and exchanges with the hosts of the sub-venues, other participating experts, and students.

Figure 10 Sub-venue submissions report (1)

Figure 11 Sub-venue submission report (2)

Figure 12 Sub-venue submissions report (3)

Figure 13 Sub-venue submission report (4)

Figure 14 Sub-venue submissions report (5)

Figure 15 Sub-venue submissions report (6)

Figure 16 Sub-venue submissions report (7)

The success of this competition has witnessed the close attention of graduate students to the economic and social development, as well as hot issues and difficult issues in the financial market in the 100-year history of the Communist Party of China. With the theoretical vision of economics and finance and the scientific method of financial technology, the graduate students explore the laws behind the problems and study the problem-solving method, which reflects the scientific spirit, academic attitude, and social responsibility.

翻译:甘若玮

审校:李昭廷、罗娇英